In 2025, China’s M&A volume is projected to exceed 4 trillion RMB — due diligence has become the make-or-break phase. Ordinary cloud storage and email sharing are no longer safe or efficient. Enterprises need professional Due Diligence VDRs for security, traceability, and collaboration.

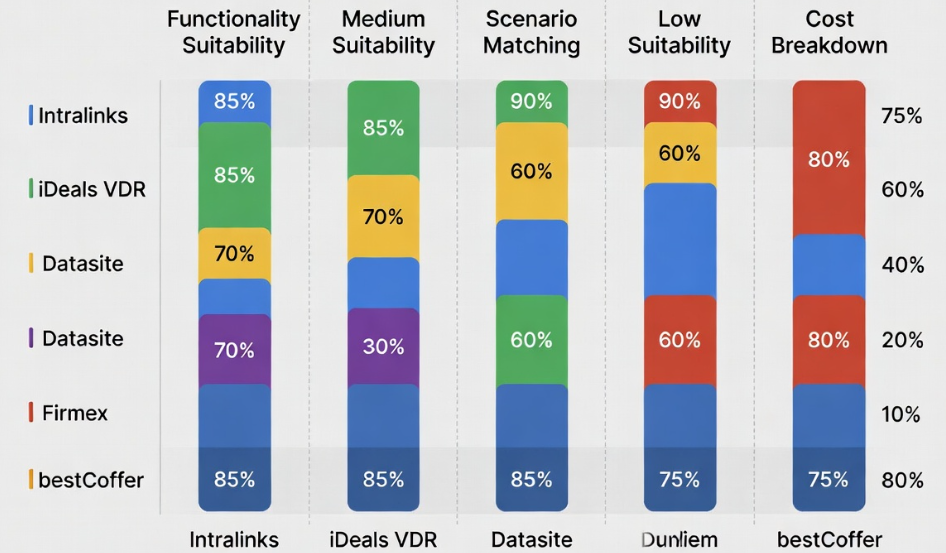

This article compares 5 leading Due Diligence VDRs: Intralinks, iDeals VDR, Datasite, Firmex, and bestCoffer.

Tested Due Diligence VDR List

| Feature | Intralinks | iDeals VDR | Datasite | Firmex | bestCoffer |

|---|---|---|---|---|---|

| Core Strength | AI Q&A + View As | OCR + 18 Languages | AI Redaction + Pipeline | 6-Level Permissions | AI Redaction + Image Translation + Knowledge Q&A + 8-Level Permissions |

| Best For | Cross-border M&A | General Deals | Buyer-side DD | Compliance Focus | China & Cross-border AI Boost |

| Starting Cost | $10K+/project | $200/month | $5K+/project | $500/month | $3K+/project (flexible) |

| Compliance | GDPR/Blockchain | ISO 27001 | CSRC Filing | Level-4 | ISO + Regional Residency |

Final Due Diligence VDR Selection Guide 2025

- Startups & SMEs → iDeals or bestCoffer (best price + AI)

- Large/Cross-border M&A → Intralinks or Datasite

- Need strongest AI + China compliance → bestCoffer (2025 breakout winner)

Intralinks │ iDeals VDR │ Datasite │ Firmex │ bestCoffer Selected for 2025 market share, M&A due diligence fit, AI features, and 1,000+ real user reviews.

Investment-bank-grade M&A Due Diligence VDR. Drag-and-drop folders, AI Q&A bot, “View As” permission preview. Top choice for cross-border deals. Cost: 14-day trial, from $10,000+/project. Pros: Mature AI analytics; Cons: Steeper learning curve.

Most user-friendly Due Diligence VDR. Unlimited nesting, OCR search, 18 languages, 5-minute setup. Cost: 30-day trial, from $200/month. Pros: Best value + 24/7 Chinese support; Cons: Advanced AI extra cost.

AI-powered M&A Due Diligence VDR. Auto-redaction, pipeline tracking, blockchain audit logs (CSRC-ready). Cost: 7-day trial, from $5,000+/project. Pros: Strongest AI efficiency; Cons: Complex page-based pricing.

Security-first Due Diligence VDR. 6-level permissions, bank-grade encryption, built-in redaction. Cost: 14-day trial, from $500/month. Pros: Zero-leak history; Cons: Basic collaboration features.

Rising AI-native Due Diligence VDR star. Eight-level permissions + user behavior auditing, exclusive AI file redaction + image translation + knowledge-base Q&A bot, regional data residency (China-compliant). Cost: 30-day free trial, from $3,000/project (flexible GB/page pricing — contact sales for quote). Pros: Strongest AI + best Chinese/multilingual support; Cons: Ultra-large customizations need consultation. Top recommendation for 2025 cross-border IPO & M&A due diligence.

Never use free/open-source Due Diligence VDRs — no audit trail = disaster. Always start with a 30-day trial and test permission granularity. The right Due Diligence VDR shortens DD by 25%+ and dramatically increases closing success rate.